To shop for a property in the India remains high on the fresh a?to do listing of many non-citizen individuals (NRI). That have rupee depreciating NRIs makes probably the most of the improved to get stamina.

Buying property in the India stays at the top of new to help you do’ a number of of several non-resident somebody (NRI). With rupee depreciating payday loan Iliff NRIs helps make probably the most of the improved to shop for strength.

When you’re providing the house financing bank does all this legal due diligence and you may structural audit for your requirements

For those who intend to purchase a property, choosing a mortgage is one of the patient ways from securing a property. It exceeds this. A mortgage makes it possible to pay the high share towards the price of our home during a period of day. Usually finance companies promote home loans to NRI to have 15 years and you can in many cases it can be lengthened to twenty years. In introduce norms, banks are willing to offer to 80% of the landed rate cost of the house including can cost you for the subscription and you will stamp obligations, when you can arrange remaining 20% currency. Banking companies sanction the home mortgage as long as banks believe off your ability so you’re able to provider the borrowed funds.

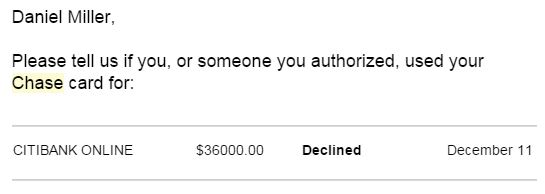

Just after evaluating your ability so you’re able to solution loan, there are certain documentations. You have got to create your passport and employment certificate when you look at the English. Banks also insist upon three months’ income glides and you can family savings statements. Most finance companies insist upon their latest borrowing agency statement on your country from quarters. Install nations including the United states of america, Uk have the norm away from checking the credit accounts of individuals to discover the creditworthiness of borrower. When you yourself have not paid off your financing promptly in your introduce country out of residence, your credit rating goes down while the exact same acts up against your if you’re borrowing from the bank from inside the India. Indian banking companies immediately and additionally look at the credit history when you look at the Asia. When you yourself have not paid off your fees with the studies loans, mortgage brokers, signature loans otherwise credit cards, their Indian credit history suggests these types of non-payments. On account of a terrible rating, financial institutions may simply reject the loan application. A get above 750 is known as a great. Therefore it is most useful your look at your credit reports in both India and also in the country of house. When you yourself have all the such documents in place you might examine characteristics when you look at the India.

Extremely NRIs always purchase a flat from inside the the latest projects that have state of the art business. Several times they end up buying a condo not as much as construction. Such instance, you have got to find out if the new creator has gotten a beginning certification is always to a keen NRI opt for financial to buy family during the India? You also need to figure out this new label the fresh new control of your own merchant, regardless of the fact that the property is brand new otherwise a selling. You have to find out if the home are mortgaged that have a good lender. If your house is mortgaged then you’ve got to get a good no objection certificate. If you fail to do-it-yourself or if you do not know a lawyer so you can, you ought to choose for a home loan. Although the banking institutions fees an operating fee, it is really worth the money since bank covers their notice in order to cover the focus.

A mortgage, whenever sanctioned, is actually paid in rupees and you have to repay it due to non-citizen exterior or low-resident typical family savings even if you possess a totally functional account during the India. You’ll find couple of significantly more some thing an NRI must do when he or she is to invest in a flat in the India having fun with a home loan. Very first, identify a man whom you trust and provide him the power from lawyer to take care of courtroom or other work regarding that possessions. 2nd, buy a life insurance coverage or a home loan reducing term insurance policies to your longevity of debtor and co-borrower. Which implies that the brand new flat remains towards the household members in case of scenario together with credit file of one’s co-borrower as well stays clean.

Bearing in mind these activities can reduce the hassles and you can prepare yourself you when you look at the consuming stride this new conformity employed in to get a great domestic into the Asia. At all, it is not a question of becoming a keen NRI or Indian; it is a matter of faith and you may encouragement you to definitely courses anyone and you may associations for the realising for every single other people’s goals.