If you are planning when deciding to take a personal bank loan, it is critical to have as frequently education you could about the borrowed funds therefore the entire recognition, Personal loan disbursement processes, and you can fees process. Specifically to pay for a monetary crisis, try to know as very much like you are able to towards Personal loan disbursement techniques. This should help you make sure to can get the mortgage amount timely to cope with whichever monetary you need. Thus, what’s the Consumer loan disbursement process? What is the Unsecured loan disbursement time the bank commonly decide to try disburse the loan? Let us glance at the complete application and you may disbursement technique to discover Personal loans better.

Personal bank loan software techniques Today, obtaining and receiving an unsecured loan is an easy means out of funding numerous types of means. Whether you are planning your second travel or remodeling your residence, Signature loans are the most effective substitute for guarantee cash flow incase you are in you desire. Of numerous banks and you may financing teams give simple and affordable Personal bank loan remedies for customers. Knowing all tips mixed up in Personal bank loan disbursement techniques, you could potentially over every formalities promptly as well as have new loan rapidly. Therefore, allows check this out of good use book to help you rating become. Beginning the process The private Mortgage disbursement procedure begins with the control of the loan application. When you submit the shape, the lending company tend to often take a couple of hours in case there is an online application or weekly for folks who use offline, to ensure your own history. Given that lender was satisfied with all the details you have offered, you’ll move on to the next phase.

Besides the application form, additionally have to fill out some file evidences getting confirmation. Make sure that all your valuable papers try duly affirmed, wherever necessary, and you may up-to-date to prevent any decrease in the process. The document demands you will change some time of financial so you’re able to bank, but not, here is an an indication number:

- ID proof

- Address evidence

- Income research

- Bank info

- Income tax Go back (ITR)

- A few passport-size images

Financing recognition After you’ve filed the mortgage application together with the desired data, the financial institution tend to begin the fresh new acceptance techniques. According to lender you select, approval can take 2-step 3 business days. Acceptance takes longer in the event the files commonly managed. So, make sure you very carefully go through the data files needed for the brand new Personal loan before entry your loan application. Loan approval gets smaller while a current customer out-of the lender.

In case the loan is approved, the financial institution will be sending your an endorsement letter by the age-post otherwise article. New sanction letter commonly speak about that your particular application for the loan might have been accepted, together with other facts including rate of interest, amount borrowed, Equated Month-to-month Fees (EMI), etc.

Personal loan disbursement time will likely be to step one-2 working days immediately following recognition. Then you’re able to go to the bank and now have a cheque on amount borrowed. Specific loan providers also mail new cheque for the target. Over the past few years, extremely lenders have started crediting the borrowed funds amount directly into new consumers savings account.

The paid amount borrowed ount approved with respect to the contract. The latest approve page is simply a simple notification on the lender indicating that you will be eligible for a specific loan under particular conditions. not, the new disbursal amount borrowed was susceptible to individuals extra formalities one to you need to over because the financing is approved.

What happens immediately after unsecured loan disbursement?

- Financing confirmation

Since mortgage are paid, the lending company will be sending your a confirmation letter for the very same. Essentially, it is delivered of the age-send otherwise article. The fresh confirmation letter usually includes a pleasant package. The greet system commonly incorporate more information regarding the financing, EMI, amortization desk, EMI fee alternatives, due dates, customer support, and much more.

- Financing repayment

Immediately following receiving the borrowed funds count, you could begin settling it for every the loan arrangement. EMI is paid thanks to Electronic Cleaning Solution (ECS) otherwise a post-old cheque.

For those who have an account on the bank at which you have taken the loan, you’ll be able to offer a condition instruction for automated EMI debit into a designated date per month. Shell out the monthly EMIs timely since non-payment otherwise later repayments get appeal punishment and you will negatively connect with the credit score.

- Are the best Borrower

It’s always better to understand all about the non-public Financing before applying for this. By doing this, you may make a and advised decision. Never merely evidently accept this new costs and you will conditions discussed by brand new debtor. See him or her properly and try to negotiate to possess a diminished attract speed if you’re able to. Carefully take a look at mortgage documents, particularly the interest rate, punishment, and you will payment choice, to eliminate one problems.

Key takeaways regarding the Personal loan disbursal process

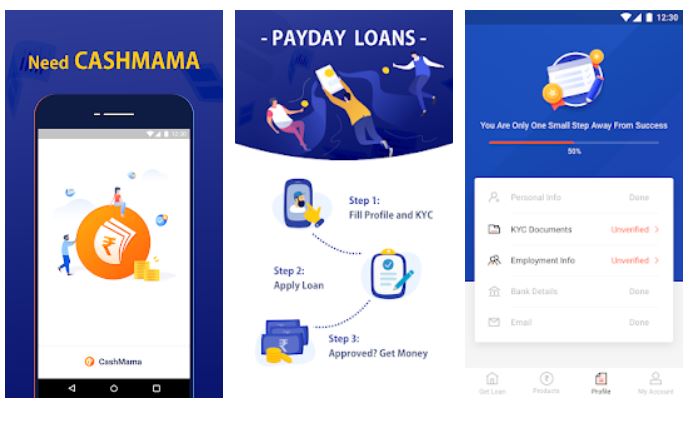

In the Digital Financing, customers can be avail of instant Personal loans digitally. They don’t really need certainly to go to the financial and you will submit the applying. The entire procedure you could do with ease to the lenders webpages otherwise mobile application.

Immediately after distribution off Consumer loan applications, the details was seemed having fun with studies analytics and you will AI. The fresh consumers past installment record is known as to suggest the choice of your applicant paying the mortgage matter. Given that bank was pretty sure off lending the borrowed funds matter, the cash is disbursed into the lender’s account within instances. It was tough toward dated old-fashioned lending steps.

Final thoughts

Perhaps you have realized, mortgage disbursement is straightforward, however, each step is important. Although the processes isnt a lot of time-sipping, you could potentially be certain that shorter disbursement because of the choosing a loan provider such as for instance Poonawalla Fincorp. Through our easy, few-step online Consumer loan software techniques, you could potentially pertain and then have the loan right away. All you need to carry out is get into your data and you can input financing requirements to begin. So why go somewhere else? Incorporate Today.