Without having a good credit score, it may be hard and you can expensive to score a consumer loan. But periodically it’s wise to borrow funds.

In the event the getting this sort of loan will allow you to regarding long run or otherwise not. So it depends on the level of the loan as well as the terminology of your loan. It will say what you propose to perform together with your personal bank loan in UAE.

High-Interest Personal credit card debt

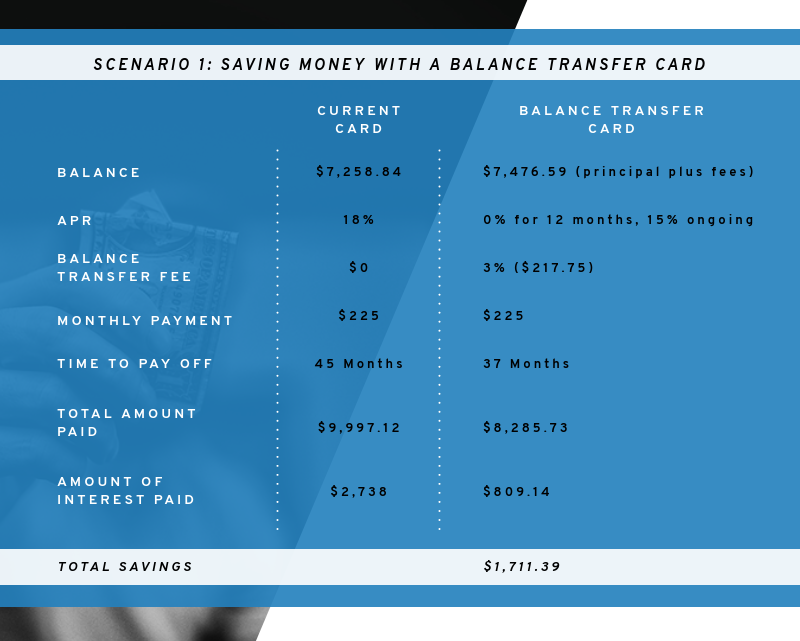

For those who have many credit card debt or other money with high rates of interest, you can get a consumer loan to repay the money and you can handmade cards at the same time. That is titled debt consolidation. Should your unsecured loan makes it possible to spend shorter attention on which your debt, it could help you save money ultimately. It can also help you create you to payment to a lender in the place of multiple payments to several credit card companies.

Unanticipated Expenses

Personal financing are going to be a cheaper treatment for borrow money than just playing cards if you want to purchase some thing unexpected.

In virtually any problem, the price of borrowing from the bank makes it possible to decide if an individual financing is a good idea or perhaps not. If your simply personal bank loan you can get is one having a leading rate of interest, it would not be worth it to consolidate.

You might like to remember the loan really works in other ways. One example is the fact different loan providers features the very least loan amount. You can merely obtain a small amount because of these lenders.

Should your application having a consumer loan try rejected since you’ve got poor credit, you can certainly do one among them two things.

Avoid Credit Money If you’re able to.

For those who made an effort to get that loan off a lender and was indeed turned-down, you can look at to obtain a consumer loan of a cards union otherwise an internet bank. There are many different personal money lenders for the UAE 2022 for people having less than perfect credit. They could accept their ask for that loan. Or, while you are applying for credit cards, select one with a low introductory speed.

Choose An effective UAE Cash loan

Cash advance is an additional great way to see debt needs. But you have to be questioning, what is an advance loan inside the UAE?

Cash fund is a variety of unsecured loan the spot where the debtor has the cash in cash. Moreover it need little paperwork, additionally the acceptance procedure is quick. There are a lot of individual currency loan providers during the UAE which will provide cash finance to those with bad credit.

Deciding to make the Borrowing from the bank Ideal

Your credit rating can move up over time for many who pay no less than the minimum on the debts punctually monthly. This may show that you have to pay the costs timely and you can pay back your debts, which can help your borrowing from the bank utilisation speed. It’s also advisable to check your credit file to own mistakes. Your credit score is damage from the an error on your own credit history.

If you research your options well, it is possible to build a sple, you can come across a knowledgeable consumer loan offered otherwise waiting to obtain that loan up until their credit improves in order to obtain the one for the most readily useful conditions.

The final Things to Say!

Maintaining good credit takes some time and you may determination for those who want to get financing that have a beneficial words. When you yourself have less than perfect credit and want that loan quickly, a very important thing you could do is advice visit an on-line financial or borrowing from the bank connection when you look at the Dubai and you may UAE that provides brief bucks finance with no borrowing checks.