It is basically hard for Deferred Action for Youth Arrivals (DACA) receiver to track down loans – but it’s nevertheless you’ll be able to. Many banks and you may loan providers commonly envision your a leading-chance private because of your updates. Of a lot banking institutions imagine DACA become temporary and not secured due to the fact DACA is very easily impacted by You.S. immigration laws. But not, DACA readers can borrow off their lenders. You can purchase unsecured loans, student education loans, and you can home loans away from banking institutions or other loan providers. This post shows you the way to get signature loans, college loans, and lenders just like the a beneficial DACA individual.

What sort of Financing Can DACA Receiver Score?

Beginning with the fresh Obama administration, Deferred Action getting Youth Arrivals ( DACA) recipients you certainly will stay-in the united states and you may availableness a work enable, license, and you can Social Defense number. Regardless of this, acquiring loans remains very hard getting Dreamers, who’re noticed highest-chance individuals.

However, Dreamers have certain loan solutions. Those with DACA status meet the criteria for personal money, figuratively speaking, and you will home loans. Your chances of effectively getting a loan confidence your own chance updates otherwise just how risky regarding a borrower you are.

Is also DACA Recipients Rating Unsecured loans?

Always, DACA recipients are eligible private finance. Unsecured loans is finance given when it comes down to individual cause. Instance, you can finance their educational costs will set you back otherwise home repairs. Although not, many loan providers envision DACA finance a large chance. Because the rules and condition regarding DACA you’ll alter at any big date, you will find a threat one You.S. Citizenship and you can Immigration Functions (USCIS) you certainly will deport you in the future. The bank perform be unable to get well its currency if that taken place.

Likewise, many Dreamers don’t have the required files or big credit rating. Many together with lack a good co-signer otherwise people willing to guarantee payment when they do not pay-off their financing. Banks tend to be unwilling to loan to DACA recipients. Nevertheless, choice individual loan providers can be expected to agree the loan consult.

Can DACA Receiver Get Loans from banks to possess College or university?

DACA program beneficiaries you should never qualify for federal low interest personal loan financial aid otherwise government student education loans. But you can talk about choice educational funding alternatives. Undocumented children qualify for during the-state university fees prices in certain says, eg New york, Florida, and you may Illinois. Your school may ask you to fill in the brand new Free Software to have Federal Scholar Help (FAFSA) to find out if their country’s Agency away from Training and/or school by itself gives you school funding.

Based your state abode updates, particular claims such as Ca, Connecticut, and you may Minnesota provides educational funding apps especially for Dreamers. You really need to contact your school’s educational funding work environment to ask your own eligibility. You might start finding scholarships and grants getting undocumented immigrants when you look at the highschool.

Likewise, specific schools and you will lenders think DACA youngsters to be global pupils. If this is the scenario, you are able to get financial help getting international people, instance private scholarships and grants or private college loans. Although not, creditors get imagine DACA student loans since the alternative finance, that’ll bring about higher interest rates. Very carefully think about the fees terms of one loan you take aside, such as the amount borrowed, interest levels, and you will whether you can find fixed rates, payment can cost you, origination fees, and you will autopay solutions.

Normally DACA Readers Get home Financing?

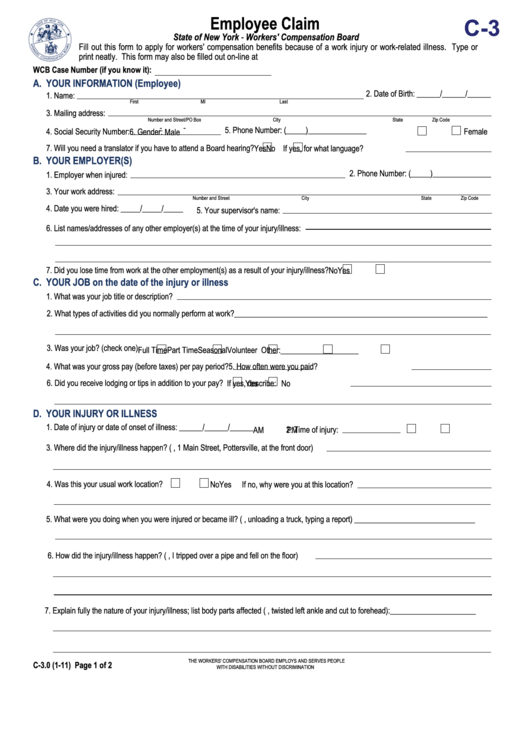

DACA readers qualify getting home loans. Often, antique banking institutions cannot accept the job, but you’ll find choice solutions. One to option is financing on Federal Casing Management (FHA) tailored clearly to own Dreamers. You’ll find four standards to help you be considered due to the fact a non-long lasting citizen:

You desire a work Consent File (EAD) out of USCIS to show you may have consent to get results regarding the You.

You could also aim for that loan regarding a personal bank. Such fund generally have less papers criteria. Yet not, they are going to probably predict the very least credit score out-of 650.

Exactly what do You ought to Submit to Score home financing as the good DACA Recipient?

There are also to show you have got a reliable income and show an account equilibrium to show you really can afford so you’re able to pick property.